INTRODUCTION:

Many of our clients either are on the receiving end of a maintenance payment or on the paying end of a maintenance payment. Maintenance (spousal support / alimony) is payment from one spouse to the other to help lower the financial stress commonly associated with a divorce. It is designed to help assist the more financially dependent spouse. Either spouse may request maintenance from the other regardless of what caused the breakdown of the marriage. A court can order maintenance payments for a temporary period of time or for an indefinite period of time after considering a number of statutory factors including the length of the marriage, the age and physical and emotional health of the parties, the division of property, the education level of each party, the earning capacity of the party seeking maintenance, the feasibility that the party seeking maintenance can become self-supporting, any mutual agreement made before the marriage, contributions to education, etc. All the factors the court considers when determining a maintenance obligation can be found in the Wisconsin State Statute § 767.56.

What made maintenance unique, as opposed to Child Support, are the tax ramifications associated with paying maintenance or receiving maintenance. If a person has paid amounts of maintenance, that payer may deduct from income the amount of maintenance paid. The recipient of maintenance payments must include it in his/her income.

This unique feature of maintenance has now completely changed under the new 2017 Tax Cuts and Jobs Act (Act). This new Act has created some of the most sweeping changes to tax law in more than thirty years. Many of the changes imposed by the new Act affects the practice of family law, and more specifically maintenance.

MAINTENANCE PAYMENT DEDUCTION ELIMINATED:

The Act has eliminated the maintenance deduction for payments under a divorce or separation decree. This new tax provision applies only to payments that are ordered in a divorce or separation degree on or after December 31, 2018. If a client is ordered to pay maintenance under a divorce of separation decree before December 31, 2018, you are grandfathered into the former tax law which permits deductions of maintenance payments.

The former spouse who is receiving the maintenance payment will no longer include the receipt of maintenance payments under income and will not be taxed on the income of maintenance like before. The same December 31, 2018, starting date applies to the reporting of maintenance income. You are grandfather into the former tax law if a maintenance order under a divorce or separation decree is made before December 31, 2018. Any maintenance order after that date will fall under the new tax law.

The Act’s treatment of maintenance payments not only applies to those payments ordered under a divorce or separation decree on or before December 31, 2018. It applies to any maintenance payment modified after the December 31, 2018, starting date if the modification order expressly states that the Act’s new maintenance provision applies (not deductible by the payer and not taxed as income to the payee).

WHAT DOES THIS MEAN FOR YOUR CASE?

This new tax law has imposed major changes to those individuals going through a divorce. It is important to speak with an attorney to discuss maintenance and to see whether there could be a maintenance issue in your specific case. Because there is no specific calculation for determining maintenance, the skilled attorneys at Anderson & Anderson will provide the best advice for your specific situation.

What you may see is a push for cases to be tried or come to a settlement agreement before the start date of the new maintenance tax laws.

If you have questions about your case and whether the new Act will affect it, contact your attorney at Anderson & Anderson Law Office, S.C.

Many of our clients either are on the receiving end of a maintenance payment or on the paying end of a maintenance payment. Maintenance (spousal support / alimony) is payment from one spouse to the other to help lower the financial stress commonly associated with a divorce. It is designed to help assist the more financially dependent spouse. Either spouse may request maintenance from the other regardless of what caused the breakdown of the marriage. A court can order maintenance payments for a temporary period of time or for an indefinite period of time after considering a number of statutory factors including the length of the marriage, the age and physical and emotional health of the parties, the division of property, the education level of each party, the earning capacity of the party seeking maintenance, the feasibility that the party seeking maintenance can become self-supporting, any mutual agreement made before the marriage, contributions to education, etc. All the factors the court considers when determining a maintenance obligation can be found in the Wisconsin State Statute § 767.56.

What made maintenance unique, as opposed to Child Support, are the tax ramifications associated with paying maintenance or receiving maintenance. If a person has paid amounts of maintenance, that payer may deduct from income the amount of maintenance paid. The recipient of maintenance payments must include it in his/her income.

This unique feature of maintenance has now completely changed under the new 2017 Tax Cuts and Jobs Act (Act). This new Act has created some of the most sweeping changes to tax law in more than thirty years. Many of the changes imposed by the new Act affects the practice of family law, and more specifically maintenance.

MAINTENANCE PAYMENT DEDUCTION ELIMINATED:

The Act has eliminated the maintenance deduction for payments under a divorce or separation decree. This new tax provision applies only to payments that are ordered in a divorce or separation degree on or after December 31, 2018. If a client is ordered to pay maintenance under a divorce of separation decree before December 31, 2018, you are grandfathered into the former tax law which permits deductions of maintenance payments.

The former spouse who is receiving the maintenance payment will no longer include the receipt of maintenance payments under income and will not be taxed on the income of maintenance like before. The same December 31, 2018, starting date applies to the reporting of maintenance income. You are grandfather into the former tax law if a maintenance order under a divorce or separation decree is made before December 31, 2018. Any maintenance order after that date will fall under the new tax law.

The Act’s treatment of maintenance payments not only applies to those payments ordered under a divorce or separation decree on or before December 31, 2018. It applies to any maintenance payment modified after the December 31, 2018, starting date if the modification order expressly states that the Act’s new maintenance provision applies (not deductible by the payer and not taxed as income to the payee).

WHAT DOES THIS MEAN FOR YOUR CASE?

This new tax law has imposed major changes to those individuals going through a divorce. It is important to speak with an attorney to discuss maintenance and to see whether there could be a maintenance issue in your specific case. Because there is no specific calculation for determining maintenance, the skilled attorneys at Anderson & Anderson will provide the best advice for your specific situation.

What you may see is a push for cases to be tried or come to a settlement agreement before the start date of the new maintenance tax laws.

If you have questions about your case and whether the new Act will affect it, contact your attorney at Anderson & Anderson Law Office, S.C.

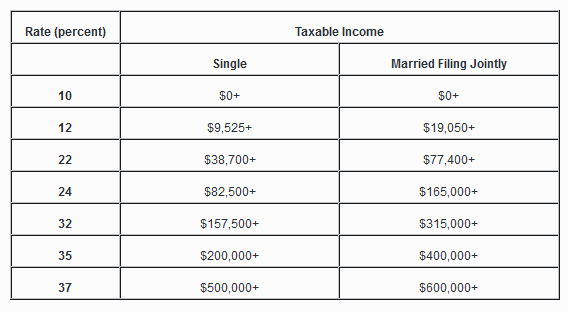

NEW INCOME TAX BRACKETS AND RATES

The information on this blog is not legal advice. Please contact an attorney for advice regarding your situation. Do not send any confidential information to us until an attorney-client relationship has been established.